A correction leading to a downturn is likely before serious

issues are resolved, such as:

Central Banks are in

a Blind Alley

Central banks can not readily afford to be even more

accommodating than they already are towards any market downturns. Even without doing anything much they are reneging

on their overdue expectations to withdraw liquidity and tighten rates. The main support they can offer is confidence

in their operations but this confidence will not last for long in the face of ineffective

action during a market downturn.

Insanely low

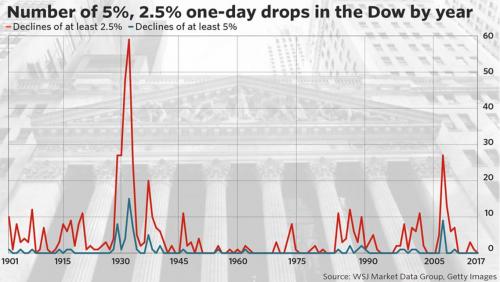

Volatility

The market has become a reflection of algo driven automated

trading, relying on mean reverting methods with an emphasis to dampening

volatility.

This is not a normal state.

Never before has the vix been so low, so much for so long. This is for both realised and implied or

anticipated volatility. This is indicative

of a central bank controlled and manipulated market.

Politics:

Debt ceiling debate,

Health care fiasco,

Tax reform,

Intrigue of the investigations behind the USPTO

A crisis in confidence in the lack of action in Washington

Unfunded pension liabilities

Instability in relations with Russia

The war drums beating for North Korea.

Why the arguments in Support

of the Bullish Case for the Market are flawed

Ultimately the valid warning signs of an over extended

market are being turned round to suggest that they represent a new area of

growth and stability. This flawed

argument is then backed by a unrealistic faith in central banks to overlook the

dilemmas coming crisis central bank policy is entering into.

1. Volatility

There are arguments that suggest the low Volatility of the

market is not a danger sign, but represent a new era of growth and

stability. This is a naive view. There is ample evidence to show that the

Volatility is dampened by Central bank actions and liquidity. Therefore, to say the cause is the natural

wellsprings of economic growth and that therefore the real cause (Central bank

liquidity) can be withdrawn is a bad trick and ought to fool no one.

Its like eating a obese man doing a days exercise and

claiming that the weight increase is muscle and the result of a new era of

fitness.

In fact, volatility is typically low when financial asset

classes are at their peak, across the board.

Low Volatility creates a market that is over leveraged,

based on expectations of continued low volatility. Therefore Low Volatility is a destabilising

influence in the event of a correction.

These investments in assets linked to Low Volatility runs in hundreds of

billions and all need to be deleveraged in a short time, in a time of limited

liquidity.

2. Private Sector

Funding.

Signs are the private Sector is investing more and hence the

Central banks can withdraw liquidity.

In fact, private sector borrowings are fantastically high,

as is leverage and borrowings in the market (based on the premise of low

Volatility continuing)

3. Central Banks

The argument is that with economic growth, reflation and private

sector funding that the central banks can keep to expectations to with draw

liquidity and tighten rates. These premises

are flawed example of circular reasoning

because they the premises are ultimately a result of central bank action in

first place

Comments

Post a Comment